Forex Trading — institutional execution & risk management

Forex (FX) trading is the global, over‑the‑counter market where currencies are bought and sold 24/7. At BlueCrest Holdings Ltd we provide institutional trading solutions — deep liquidity access, algorithmic execution, tight risk controls and bespoke hedging programs — so clients can trade FX efficiently and manage currency risk across portfolios.

Contact the FX Trading Desk

Trading philosophy

We treat FX as both a market for trading and as a portfolio risk to be managed. For clients requiring hedging we prioritise robust, low-cost execution and transparent forward pricing. For active trading mandates we deploy algorithmic strategies, smart order routing and best‑execution processes across multiple liquidity providers.

Key trading principles

- Access deep, multi‑venue liquidity to minimise slippage.

- Use algorithmic execution where it reduces market impact and improves fill quality.

- Combine quantitative signals with macro risk assessment for tactical positions.

- Maintain strict risk controls and pre-trade limits for client mandates.

Quick highlights

24/7 market access, aggregated liquidity, and institutional‑grade execution and reporting.

Read our FX researchPosition sizing & hedge helper

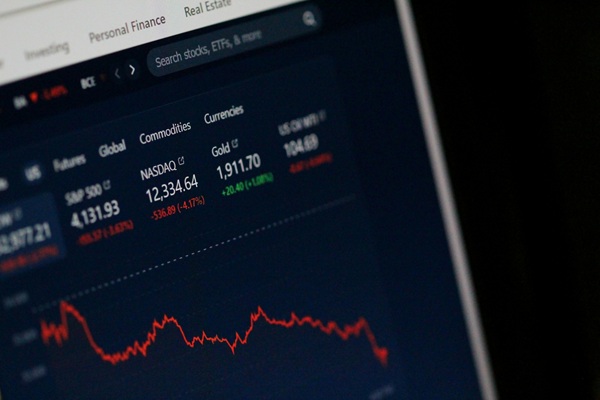

FX Volatility snapshot

Below is a sample snapshot of recent realized volatilities across major currencies. For live monitoring and trading signals, we can wire this panel to your market data feed.

- EUR: 8.2% (annualized)

- GBP: 7.5% (annualized)

- JPY: 10.3% (annualized)

- AUD: 11.0% (annualized)

- USD (implied benchmark): 7.0% (annualized)

Note: these are illustrative figures for demonstration. We can integrate live realized and implied vol surfaces when connected to a data provider.

Execution & services

BlueCrest offers multi‑venue liquidity aggregation, smart order routing, algorithmic strategies, and institutional reporting — all under strict risk controls.

Deep Liquidity

Access to multiple prime liquidity providers and responsive execution strategies to minimise slippage.

Execution Technology

Smart order routing, algos and pre‑trade analytics to improve fill quality and manage market impact.

Monitoring & Governance

Real‑time P&L, post‑trade reporting and stress testing so trading programs remain within mandate limits.

How we work with trading clients

- Discovery: define objectives, risk limits and operating hours.

- Design: choose execution toolkit — algos, DMA, or principal trading.

- Implement: connect via FIX/API and begin execution with pre-trade controls.

- Monitor: real-time oversight, post-trade analysis and periodic review.

Discuss a trading mandate

Connect with BlueCrest's FX Trading desk to set up institutional liquidity, execution algos or bespoke hedging programs.